About Hida Health

We understand that one plan or one company does not fit all. We consider YOUR personal needs and budget before making a recommendation. You can expect our sincere and honest opinions when evaluating your needs. We are dedicated to changing your opinion of this industry. It’s not about selling, but helping solve problems.

When we say "I want to be your Agent", we mean for life. Long after you enroll, to assist when you need us most.

“You are in good health when your body and mind are at peace.” Wellness in Cherokee is described as the “harmony between mind, body, and spirit”. As a member of Cherokee Nation, our founder is proud of her lineage and wanted to incorporate some respect to it in the company name.

“To help find affordable coverage for those with urgent medical needs & any minority & low income individuals.”

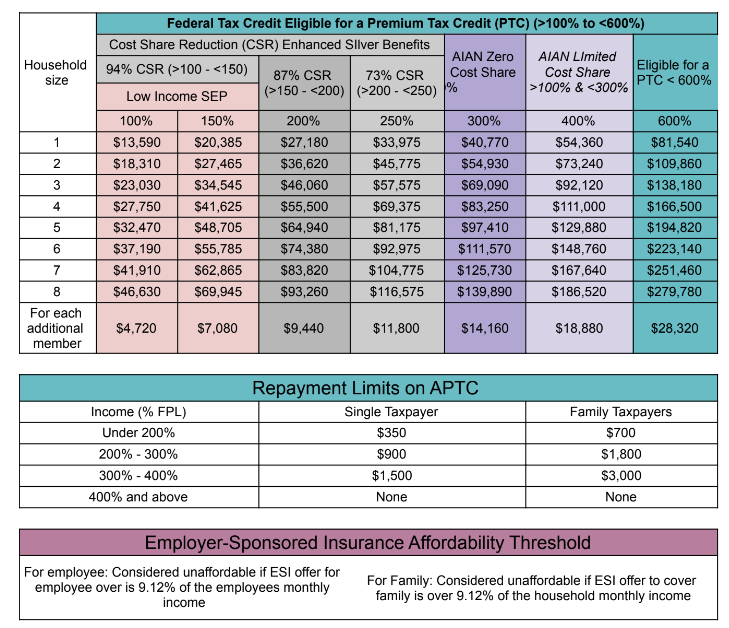

The Affordable Care Act ensures all person’s legally residing in the US have access to healthcare that will not deny care due to medical history. The program also provides assistance to those who are not qualified for Medicare or Medicaid, do not have a plan offered from their employer, and have income under 600% of the poverty level. Individuals and families who are under 150% of the poverty level qualify for enrolling in plans year around, as opposed to the standard requirement to enroll during Annual open enrollment (Nov 1 - Jan 15).

See the chart in our financial assistance tab to see if you qualify for financial assistance!

An HMO, or Health Maintenance Organization, is a type of health plan that offers a local network of doctors and hospitals for you to choose from. It usually has lower monthly premiums than a PPO or an EPO health plan. An HMO may be right for you if you’re comfortable choosing a primary care provider (PCP) to coordinate your health care and are willing to pay a higher deductible to get a lower monthly health insurance premium.

A Preferred Provider Organization (PPO), is a type of health plan that offers a larger network so you have more doctors and hospitals to choose from. Your out-of-pocket costs are usually higher with a PPO than with an HMO or EPO plan. If you're willing to pay a higher monthly premium to get more choice and flexibility in choosing your physician and health care options, you may want to choose a PPO health plan.

An Exclusive Provider Organization (EPO), is a type of health plan that offers a local network of doctors and hospitals for you to choose from. An EPO is usually more pocket-friendly than a PPO plan. However, if you choose to get care outside of your plan’s network, it usually will not be covered (except in an emergency). If you’re looking for lower monthly premiums and are willing to pay a higher deductible when you need health care, you may want to consider an EPO plan.

A Point of Service (POS), as with an HMO, requires that you get a referral from your primary care physician (PCP) before seeing a specialist. But for slightly higher premiums than an HMO, this plan covers out-of-network doctors, though you’ll pay more than for in-network doctors. This is an important difference if you are managing a condition and one or more of your doctors are not in network.

A high-deductible health plan (HDHP), is an inexpensive health insurance plan with low premiums but a very high deductible. Because they may come with significant out-of-pocket expenses, these plans are popular for young, healthy workers with low routine medical expenses who are worried about catastrophic health care events.

An HDHP can be an HMO, POS, PPO or EPO. People who are managing a health condition but can’t afford higher monthly premiums may find that an HDHP saves them money in the long run.

An additional benefit of high-deductible plans is the Health Savings Account (HSA), which is only available to workers with a HDHP. These savings accounts are tax-free, so long as the money is used for qualified medical expenses.

A High Deductible Health Plan (HDHP) has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account (HSA) funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account to cover medical expenses, saving you about 30%. And remember, depending on your age, services such as mammograms, colonoscopies, annual well visits and vaccinations may be covered free of charge, even if you haven’t met your deductible.

Many tribes have healthcare facilities available on tribal land and reservations, however, only 1/3 of the American Indian or Alaska Native (AI/AN) population lives on reservations, with another 26% living in counties surrounding tribal areas. Therefore there is much need for affordable healthcare access outside of the nations. Not to mention, sometimes access to care at Tribal facilities is often crowded or lacking specialties that may be needed by native individuals.

The ACA solves this issue for Native Americans, unfortunately so many do not realize what great benefits they have available to them! Oklahoma and Arkansas, for example, have real PPO coverage that, depending on income, may offer totally free premiums with $0 deductibles and out of pocket Max.

Our goal is to reach as many Natives who may need assistance described above. Sadly, Native Americans have the highest poverty rate among all minority groups in the U.S. Although we wish to help all minorities and low income individuals and families, the native community is one very close to our hearts.

The Affordable Care Act ensures all person’s legally residing in the US have access to healthcare that will not deny care due to medical history. The program also provides assistance to those who are not qualified for Medicare or Medicaid, do not have a plan offered from their employer, and have income under 600% of the poverty level. Individuals and families who are under 150% of the poverty level qualify for enrolling in plans year around, as opposed to the standard requirement to enroll during Annual open enrollment (Nov 1 - Jan 15).

The Hida Health Process

After scheduling a call, you will enjoy a painless and pressure free, 15 minute discovery call to make sure we custom build the plan that’s exactly right for you, your business or your family. You will have all the time you need to examine the plan options presented to you.

Once you decide the plan and insurance company that’s right for you, another simple 15 minute call is scheduled for your application process. As we will be representing you throughout the entirety of the plan, we do the application together and it is typically sent in by us via our telephone and screen share application process.

Once the application is completed and the insurance company has accepted you into their program, you will not only have your Hida agent’s support at any time, but you will be assigned your own personal customer service liaison. We humbly request that our clients do not call insurance companies. It is our pleasure to wait on hold for you, watch your back, and ensure doctors/hospitals/insurance & pharmaceutical companies also have your best interest at heart.

Our Services

Hida Health Insurance Advisors provides multiple tiers of coverage to suit your individual or family needs.

Private PPO plans on the largest Nationwide network in the country! Underwritten and geared towards the self-employed.

Private PPO plans on BCBS or PHCS nationwide networks. lightly underwritten, MEC plans.

On and Off Exchange plans, designed to keep your family safe regardless of health history.

Supplemental coverage to cover costs that your health plan doesn't in the case of accident/Injury or a critical illness

ACA/Marketplace Enrollment on exchange with Subsidy assistance for low income families

ACA/Marketplace Enrollment on exchange with Subsidy assistance for low income families ACA/Marketplace Enrollment - Off Exchange

ACA/Marketplace Enrollment - Off Exchange Medicare and Medicare Supplements

Medicare and Medicare Supplements Full Coverage, Private underwritten plans with low max out of pockets on a national, major PPO network.

Full Coverage, Private underwritten plans with low max out of pockets on a national, major PPO network. Short-term Medical coverage (United, Cigna & Aetna Networks)

Short-term Medical coverage (United, Cigna & Aetna Networks) Small & Medium Group plans for small businesses to offer their employees (Blue Cross Blue Shield & United Networks)

Small & Medium Group plans for small businesses to offer their employees (Blue Cross Blue Shield & United Networks) Dental &/or Vision insurance

Dental &/or Vision insurance Supplemental Accident Coverage &/or Critical Illness

Supplemental Accident Coverage &/or Critical Illness Life insurance

Life insuranceWE'RE HERE TO HELP

Our agents have put together a comprehensive list of all of our Frequently Asked Questions, so that you can find all of the information in one place.

A health insurance advisor is typically an individual, who has access to multiple carriers and plans. A great health insurance advisor will listen to your situation, discuss all of your options with you, and let you choose what best fits you and your family.

Hida Health Insurance Advisors is licensed and insured to provide you a safe, and professional experience. We never sell, share, or publish your information with any third parties. Your information is safe, secure, and only used to show real, viable products with carriers you've heard of before.

Although health insurance can be complex, it can be made simple if speaking with a licensed professional who can break things down in an easy to understand way. All health insurance will have similar terms like, deductible, co-insurance, co-pays and max out of pocket. Hida Health is known for breaking down plans in their simplest terms to make sure you understand exactly what you are paying for and how your plan works.

Health insurance cost can vary depending on a few factors, such as age, zip code and income. To figure out what is most cost-effective for you, it is important to get in contact with an agent that is licensed in your state and has access to all the plans on and off the marketplace. Hida Health Insurance Advisors takes an educational approach, making every client an expert in the health insurance world, and showing them all of their options to choose from.

Affordable health insurance is attainable typically through income based subsidized or private underwritten plans. A principle we stress at Hida Health is obtaining affordable insurance, not "cheap" insurance. Because cheap insurance is the most expensive insurance when something bad happens. With our agents having access to all public and private options, we are experts at finding individuals and families affordable health coverage.

A health insurance agency is a group of agents that work under a company to sell insurance products to consumers. Hida Health Insurance Advisors is an independent agency that provides access to a range of health insurance products from multiple carriers in one place. With Hida Health Insurance Advisors, you can choose from a wider range of carriers.

Health insurance agents are licensed salespeople who represent one or more insurance companies. They are licensed to sell in certain states, and can’t charge you any fees for assisting you in obtaining health insurance for you and your family. Captive agents are agents that represent only one insurance carrier/company; meaning they work exclusively for that one company. These agents represent their company, not their clients. They can only sell you coverage that their one company offers.Here at Hida Health Insurance Advisors, we don’t have any captive agents; meaning we represent you, not the tens of companies we service for. This ensures that we will find the best coverage for you, your family, and your business’ unique situation.

Underwritten health insurance involves an application process where the insurance company will look at you and your family’s medical and prescription history. If you’re able to get approved through that process, not only can you get a plan with a nationwide PPO, but it often is more affordable than other health insurance options because you are put into a network of other healthy individuals and families.

A Family health insurance is a plan that covers any members in your household. Most family plans have a family deductible & Out of Pocket Max which may result in a lot of savings when you have a larger family size than 1-2 members.

What family members can be on your family health insurance plan? Spouse and your dependents under the age of 24-26 (dependent upon your state of residence). For instance, if you're married without any children or dependents, your family plan would really just be for the two of you.

If you had a spouse and 6 kids (under ages 24-26), your plan would cover your family of 8. If you get family health insurance through an employer, they’ll more than likely use the term “employee plus family.” This will work the same way for your family as what is stated above.

Nationwide PPO is typically the term used for a health insurance plan that has a large enough network to cover you across the country, not just in a smaller local network, like an HMO, for example. When looking at health insurance options, obtaining a nationwide PPO would give you access to more providers and specialists in your area and across the country without any requirements of needing referrals to see specialists.

Short terms are health plans with a limited duration designed to bridge a gap between longer-term plans and are exempt from most insurance regulations and not required to provide coverage for all health issues. Also referred to as Short-term or limited-duration insurance. Short terms are best known for underwriting at the point of a claim, meaning when a claim happens they go digging through your medical records looking for a reason not to cover you. The attraction is typically the low price, however people don't realize there are plans that are comparable in price that have to cover your claims.

Multi-plans are Limited-benefit plans that are primarily designed to supplement comprehensive health care policies, not to replace them. They do not provide comprehensive coverage.

Marketplace health insurance also referred to as On-Exchange, ACA or “Obamacare”, is a federal based insurance program that partners with private insurance carriers to provide income based pricing and coverage for all US citizens and residents. The Affordable Care Act implemented coverage standards that prevent insurers from discriminating against applicants or charging them higher plan premiums - based on preexisting conditions or gender.